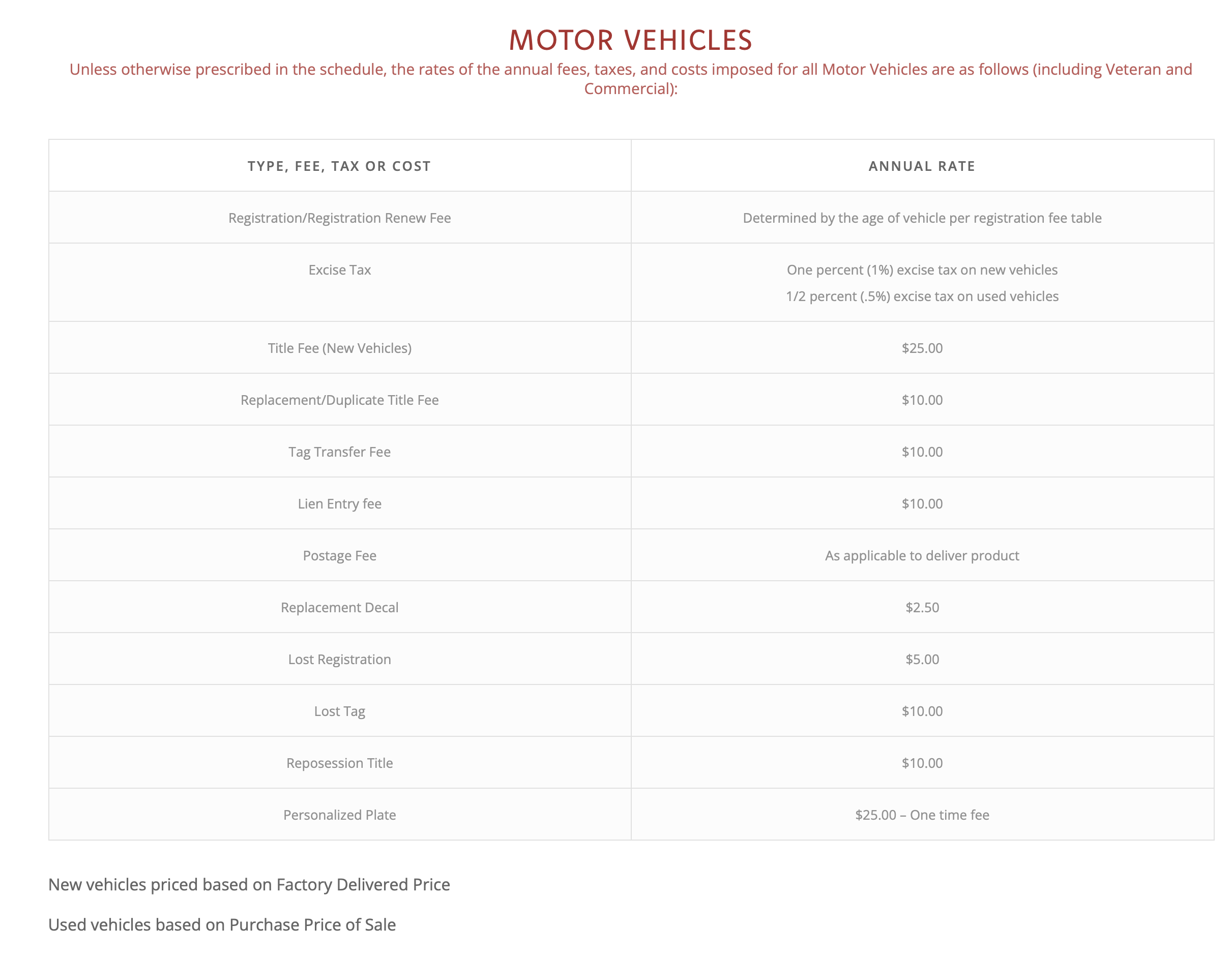

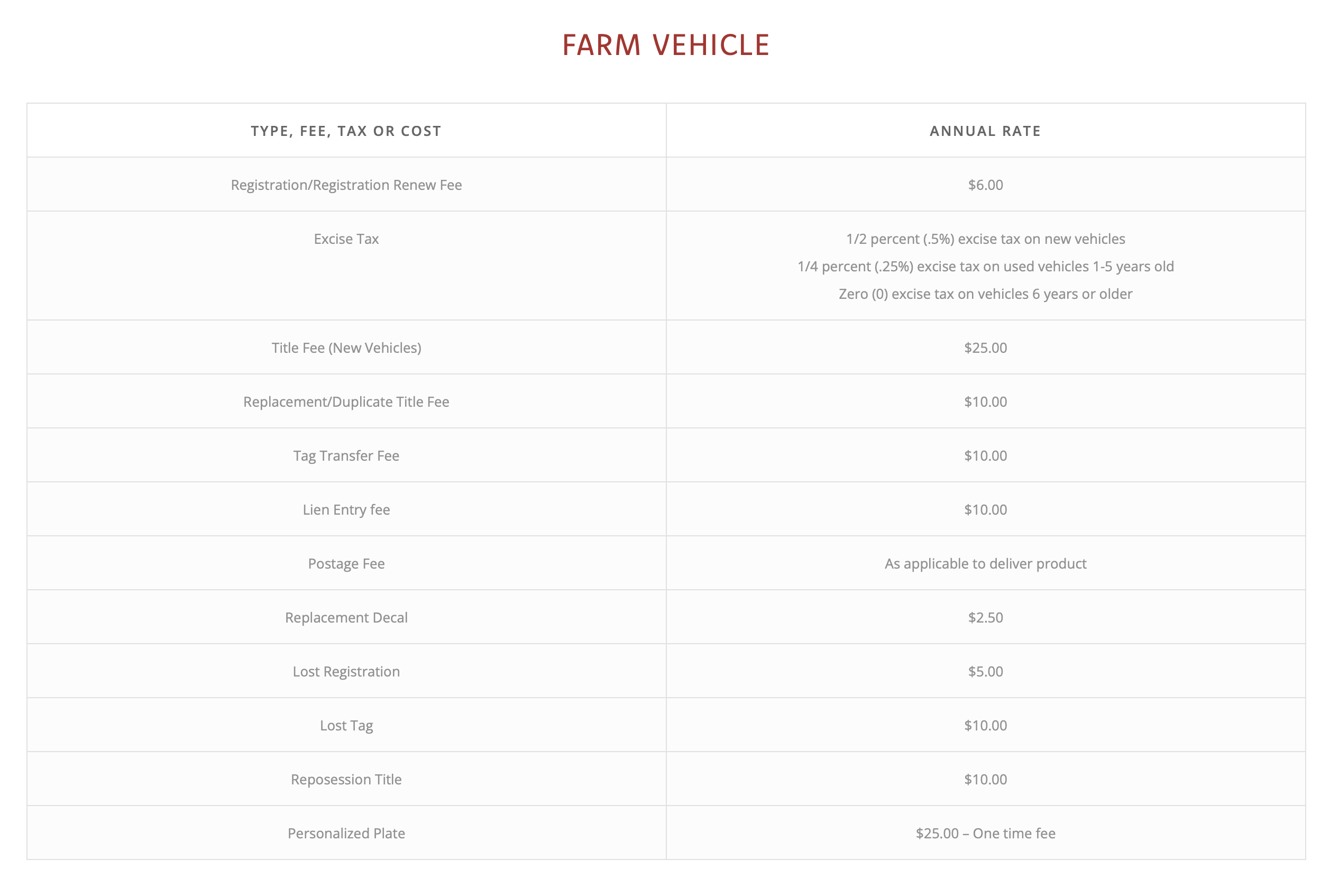

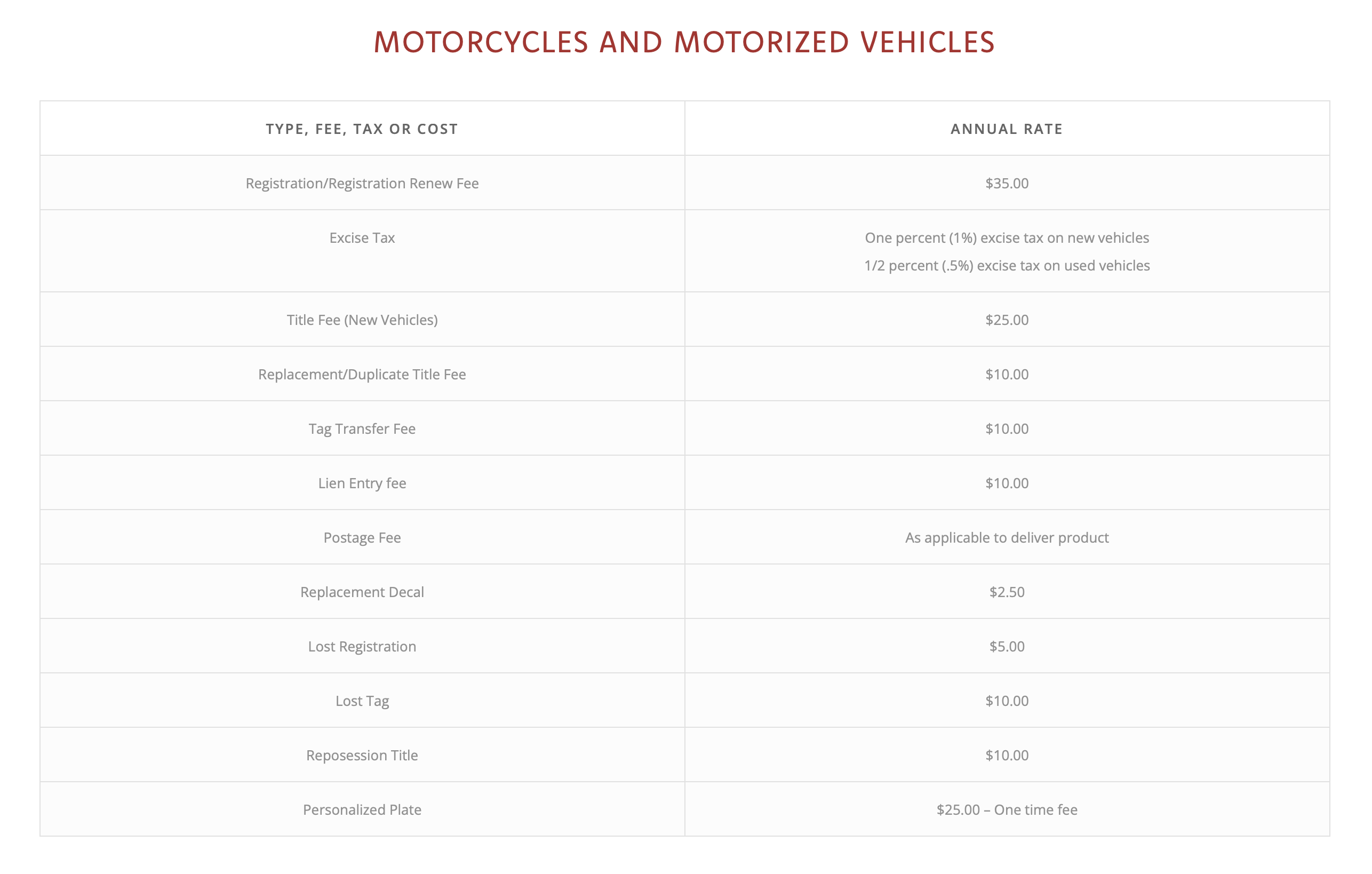

The Peoria Tribe Tax Commission is now issuing Peoria Tribal tags for Peoria Tribal citizens residing in Oklahoma.

Monday – Friday 8:00 am – 4:30 pm, located at 118 S. Eight Tribes Trail, Miami, Ok 74354. Effective January 24, 2022.

The following is required to request a NEW tag:

- Valid Oklahoma Driver License

- Original Vehicle Title (properly signed over; new and used purchases have 30 days before penalties begin)

- Valid Current Insurance Verification (for non-use vehicles, complete and submit the Affidavit of Nonuse form)

- Tribal Citizenship Card (not CDIB card)

- Lien Information (Lien Entry or Release)

- Peoria Disclaimer Form

- Bill of Sale

The following is required for a tag RENEWAL:

- Valid Oklahoma Driver License

- Valid Current Insurance Verification

- Tribal Citizenship Card

When calling for a quote, have the actual purchase price and the year of vehicle on hand.